AI-enabled platform business model for legacy companies

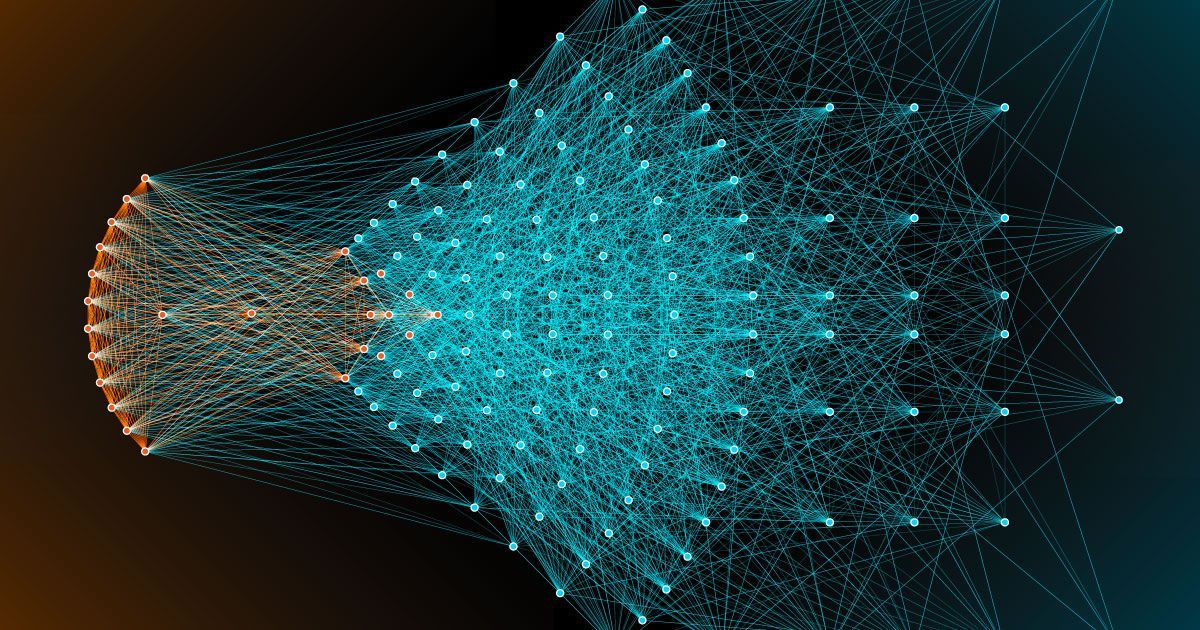

How Network Orchestration Business Models are enabled by AI technologies.

Platform companies like Facebook, Amazon, Google, and Tencent have created value at stunning rates. They grow rapidly and own few assets — and they’ve all made strong use of AI. What can legacy companies learn from these platforms? And is it possible for legacy companies to use this business model, too?

The growth of artificial intelligence has enabled a variety of new strategies and business models, from programmatic ad targeting to the sharing economy to the metaverse. The companies that have been most successful in employing these models — digital natives, almost to a one — have been “multi-sided platforms,” in which a company at the hub of an ecosystem or business network coordinates services and reduces friction for customers. Facebook, Apple, Airbnb, Amazon, Google, Uber, Alibaba, Tencent, and the other leading platform companies have created value at astounding rates.

It’s no coincidence. Research has shown that multi-sided platforms have the highest valuations of the dominant alternative business models — more than four times the annual revenue multiples attached to some legacy business models. This is largely because they grow rapidly and have to own relatively few assets themselves.

Platform business models typically generate large volumes of data from all participants in the ecosystem, and AI is required to make sense of it all. Machine learning helps match customers with the products and services they need or want, and provides a seamless experience across the ecosystem. And the millions of customers that use platforms need highly efficient customer service, i.e., intelligent agents and chatbots. So, it’s not surprising that the leading platform firms listed above are also world leaders in the application of AI to their businesses.

But traditional businesses can also organize multi-sided platforms. They too can use data and AI models to orchestrate services for customers across an ecosystem of companies. It requires new strategies, new technologies, and new business relationships, but when companies make the transition successfully, they can achieve the rapid growth and customer loyalty that the digital native platforms have accomplished.

There’s evidence that more traditional firms that employ AI aggressively are adopting an ecosystem (and perhaps eventually a platform-based) approach. In the Deloitte 2021 State of AI in the Enterprise survey, the two highest-achieving groups of AI users in the survey were substantially more likely to have two or more ecosystem relationships (83% among the two highest groups, versus 70% and 59% among the two lowest groups). Companies with more diverse ecosystems were 1.4 times as likely to use AI in a way that differentiates them from their competitors. In addition, organizations with diverse ecosystems were also significantly more likely to have a transformative vision for AI, to have enterprise-wide AI strategies, and to use AI as a strategic differentiator.

These firms may not have full-fledged platform business models, but creating broader ecosystem relationships is a first step toward AI-enabled platforms. Beyond that step, here’s how companies are turning themselves into platforms with AI.

Not Just Digital Natives

A few “legacy” companies have already created AI-enabled platform models. Using these models, the companies are generating more customers, leading to more data, leading to better models, leading to better customer offerings — a virtuous circle. Others are in earlier stages but hope to eventually achieve the same outcome.

Perhaps the single best example of the virtuous circle from platforms is Ping An in China, which began as an insurance company in 1988 but now describes itself in terms of its five ecosystems — financial services, health care, smart cities, automobiles, and real estate — each of which constitutes a platform. In health care, for example, Ping An’s platform connects government, patients, medical service providers, health insurers, and technology. The Ping An Good Doctor system provides both online and in-person consultations, and uses AI to dispense medical advice to members with mobile devices.

The size of the ecosystem is staggering — it provides diagnosis and treatment for more than 3,000 common diseases, has almost 350 million users, more than 1,800 medical and nursing practitioners, and nearly 10,000 health care experts across China. It partners with 110,000 pharmacies, 49,000 clinics and more than 2,000 medical examination centers. In 2020 it performed more than 830,000 medical transactions per day. These numbers illustrate not only the size of China’s population, but also the rapid scaling possible with a platform-based business model.

While the primary value of the platform is to grow the business and provide effective health care, it’s also useful for accumulating insights to train AI models. The Ping An health care ecosystem can draw upon claims and payments data from payers, treatment data from care providers, prescription data from pharmacies, symptom data from patients, and other types of data from other ecosystem members. By 2020 Ping An had data on more than 30,000 diseases and more than a billion medical consultation records.

Several other AI-fueled companies, including Airbus’s Skywise, Shell, Anthem, and SOMPO in Japan are also pursuing the ecosystem idea, but are at earlier stages than Ping An. At this point they are still exploring business and revenue models, but are pursuing data sharing and integration approaches, and beginning to develop AI applications to analyze the data.

How Midsize Companies Can Compete

It’s not just major companies with big R&D budgets that can make this pivot, however. CCC Intelligent Solutions, founded in 1980, illustrates how a midsize company can compete effectively using an AI-enabled platform model. Its platform is focused on digitizing the automotive insurance economy, and easing claims and damage repair friction for millions of drivers every year. Through its relationships with more than 300 insurers, more than 27,000 repair facilities, more than 4,000 parts suppliers, and all major automobile OEMs, it has assembled more than $1 trillion of historical claims data, billions of historical images, and other data on automobile parts, repair shops, collision injuries, regulations, telematics and multiple other entities. As with several of the other ecosystems mentioned above, each new member provides more value to the network and more data, leading to better AI models.

CCC aggregates data — and increasingly, powers AI-enabled decisions — for its platform in order to quickly and efficiently process claims for the end user. All of the resulting transactions take place in the cloud, which connects 30,000 companies, 500,000 individual users, and $100 billion in commercial transactions.

Over the past several years CCC has developed a “touchless” claims offering that is being used by USAA and other leading insurers. Insured customers who are involved in an accident can take guided photos on their mobile devices, send them to their insurer, and receive an automated estimate in seconds. Such an AI-enabled innovation required years of technology refinements, as well as collaboration with ecosystem members to integrate the capability into their claims and repair processes.

What It Takes to Succeed with AI-Based Platforms

The companies above all have different business needs and are deliver different services, but there are common threads in how they’ve approached their platform pivots. Companies wishing to create and prosper with AI-enabled platforms need to accomplish a series of steps. They include:

Strategize about how ecosystem relationships will improve your offerings, and seek out those partnerships. Business strategy will dictate what platforms your company needs to form and how that will improve its products and services. Implementing the strategy may require building or buying new business capabilities. Ping An, for example, decided that instead of offering only insurance services it would build a financial supermarket for customers. It already had some capabilities, but it built a wealth management offering (Lufax) and bought an automobile portal (Autohome).Ensure that data comes with the relationship. A big part of the value of the platform is access to partners’ data, so ensure that partnership deals include access to the needed data and the ability to use it in AI models like customer/offering matches and recommendations.Develop an API-based IT services architecture. Ecosystem partners will need to easily access data and decisions made by AI systems. By far the easiest way to do that is with application program interface (API) architectures. CCC, for example, has built its cloud-based API network that lets providers easily interface with the company.Identify the key decisions that AI needs to make, and gather the data to train models. In most cases AI will be used to make a decision. For Ping An’s health care platform, key decisions include what is a patient’s most likely diagnosis, whether the patient needs to visit a doctor, and what is the recommended treatment. The decisions facilitated by CCC’s platform include the exact damage to a vehicle and the cost to restore it, which ecosystem partners need to be involved in the repair, and which off the needed services.Design a seamless process from the customer’s standpoint. A major part of the appeal of an platform model for customers is removing friction so that they don’t have to understand all of the participants and complexities involved in a solution, whether it’s a medical treatment, a collision repair, or airplane maintenance. Companies creating a platform need to work with their partners to design and implement a smooth, seamless process to meet the customer need.Use data from across the ecosystem to improve models and offerings. The machine learning models that power platform decisions are not a “set and forget” approach. They will get better at predicting or recommending over time if they are retrained on new data. They should be retrained whenever major new data sources emerge, or when they are no longer doing an effective job at the decision with which they are charged.

Looking at legacy firms that have successfully done just that, companies should:

- Strategize about how ecosystem relationships will improve your offerings, and seek out those partnerships.

- Ensure that data comes with the relationship.

- Develop an API-based IT services architecture.

- Identify the key decisions that AI needs to make, and gather the data toBoth the digital native platform companies, and the legacy companies we’ve studied as well, illustrate the value of an AI-enabled platform business model for companies and their customers. It’s difficult to grow rapidly without a set of close business partners, and it’s difficult to make sense of their data and provide value to all parties without AI. We expect to see many more of these platforms in the future. train models.

- Design a seamless process from the customer’s standpoint.

- Use data from across the ecosystem to improve models and offerings.

Both the digital native platform companies, and the legacy companies we’ve studied as well, illustrate the value of an AI-enabled platform business model for companies and their customers. It’s difficult to grow rapidly without a set of close business partners, and it’s difficult to make sense of their data and provide value to all parties without AI. We expect to see many more of these platforms in the future.

by Alessio De Filippis, Founder and Cheif Executive Officer @ Libentium.

Founder and Partner of Libentium, developing projects mainly focused on Marketing and Sales innovations for different type of organizations (Multinationals, SMEs, - Start-ups).

Cross-industry experience: Media, TLC, Oil & Gas, Leisure & Travel, Biotech, ICT.